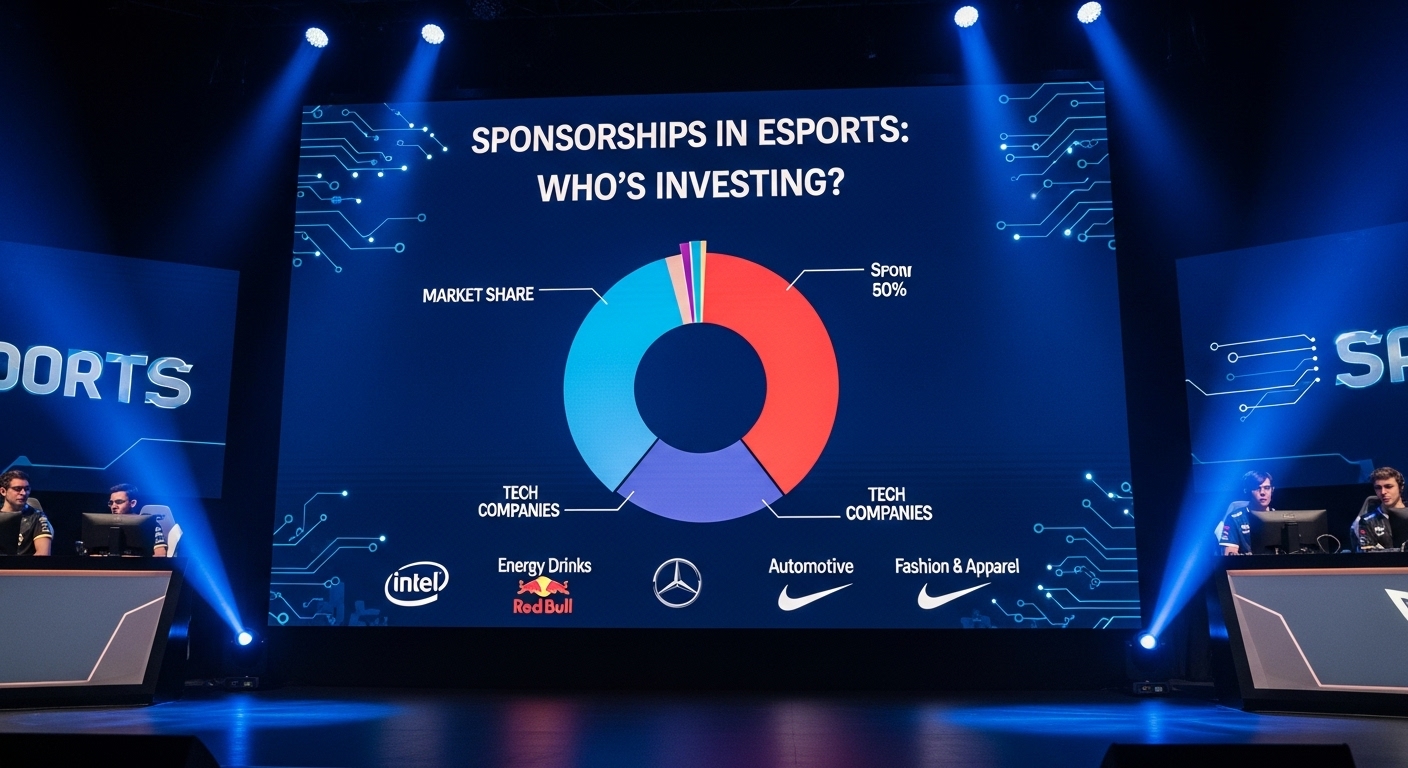

Esports sponsorship isn’t a new story — brands have been slapping logos onto jerseys and stream overlays for over a decade — but the who and the how have shifted dramatically. What started as an ecosystem dominated by endemic brands (hardware, peripherals, energy drinks) is now a global marketing channel for major non-endemic players: apparel giants, automakers, banks, and consumer packaged goods companies. In this long-form deep dive I’ll unpack who’s investing in esports today, why they do it, how they activate those investments, what success looks like, and where sponsorships are headed next.

Quick primer: endemic vs. non-endemic sponsors

First, a quick definition so we’re on the same page.

- Endemic sponsors are companies whose products or services are closely related to gaming: GPU makers (NVIDIA, AMD), headset and keyboard companies (Logitech, Razer), energy drinks and snack brands that have long targeted gamers, and gaming-focused platforms (Steam, Epic, console/PC manufacturers). These companies were the earliest — and for many years, the primary — backers of teams and tournaments.

- Non-endemic sponsors are brands from outside the gaming/Gear-and-Tech world: automakers, fashion and footwear companies, banks and fintech firms, beverage conglomerates, travel brands, telcos, and so on. Their reasons for entering esports range from reaching younger audiences to experimenting with new kinds of content and experiential marketing.

The important shift in the last few years: non-endemic sponsorship is no longer experimental or rare. It’s a core part of how big brands attempt to connect with digitally native audiences. Analysts and industry insiders now regularly forecast a continued inflow of non-endemic money into esports partnerships and event rights.

Who’s investing? The big categories and notable examples

Let’s break it down by industry and give real-world examples to show how each category approaches esports.

1. Energy drinks and beverages — the evergreen endemic backers

Energy drinks were some of the first mass-market brands to make esports a marketing priority. Red Bull, Monster, and similar brands sponsor teams, events, and creators — and they do it in a way that’s integrated with event activations, athlete programming, and content. Red Bull, in particular, has extended its presence from team and event support into content creation and cross-sport athlete ambassador programs, making it a model for how a beverage brand can be tightly woven into esports storytelling.

Why they invest: natural demographic overlap (young, male-skewed audience historically), high engagement, and branding that matches “energy,” performance, and youth culture.

2. Hardware & tech — endemic, but evolving

Intel, AMD, NVIDIA, and peripheral makers remain large investors. Their ROI is direct: product placement at tournaments, co-branded hardware, and technology partnerships (e.g., providing servers, streaming tech, or performance analytics). For them, credibility matters — a tournament powered by the wrong CPU brand is a no-go — so their sponsorships are both promotional and infrastructural.

Why they invest: direct product relevance, endorsement credibility, and clear conversion funnels (gamer sees rig at event → wants similar parts).

3. Apparel, footwear & fashion — mainstreaming esports culture

Legacy sportswear brands like Nike and Adidas and fashion labels have stepped into esports in recent years, sponsoring teams, outfitting players, and sometimes co-developing capsule collections. The move signals that esports creators and teams are now seen as cultural tastemakers, not just players. Partnerships can be simple uniform deals, or deeper collaborations like training kits, joint retail experiences, and branded facilities.

Why they invest: reach into Gen Z & younger millennials, cultural relevance, and storytelling (athlete-as-influencer model). Evidence shows apparel brands are accelerating deals across leagues and regions.

4. Finance & fintech — paying for fandom

Banks, card networks, and fintech firms have taken an interest in esports in part because younger audiences are attractive to long-term customer acquisition and in-part because fintech products fit well with digital-native behaviors. These sponsors typically prefer premium league or event rights, co-branded experiences, or team partnerships that enable transactional integrations (e.g., exclusive offers, ticketing, NFTs with payments tie-ins).

Why they invest: long-term customer value, brand modernisation, and access to a digital-first demographic. Some big campaigns and rights deals highlight their focus on high-visibility, credibility-building partnerships

5. Automotive & travel — experiential and lifestyle plays

Automakers and travel brands enter esports for two reasons: 1) to make their brands feel relevant to younger audiences, and 2) to connect via experiential marketing — think branded fan zones, VIP travel experiences to tournaments, or co-developed creator content. These are high-investment, high-visibility deals that often tie into global esports events or league sponsorships.

Why they invest: reach, prestige (major tournament sponsorships are premium real estate), and experiential activations that can be translated into test drives, showroom events, or digital product demos.

6. Consumer packaged goods — soft-power brand building

Coke, Pepsi, and other big CPG brands are starting to view esports as an essential channel in their multi-platform youth strategies. These deals emphasize content, influencer-led campaigns, and community experiences rather than simple logo placement.

Why they invest: maintain cultural relevance and secure habitual presence within a young consumer’s daily media diet.

How brands activate esports sponsorships

Sponsorships today are less about “stick logo on jersey” and more about integrated activations across product, content, and experience. Here’s how brands commonly activate investments:

- Content-first programs: Brands co-create content with teams and creators (outlined series, behind-the-scenes documentaries, and personality-driven short formats). Content can run on streaming platforms, social media, or in branded hubs.

- Event activations: Pop-up experiences, hospitality suites, fan zones and IRL events at tournaments remain critical. These let brands translate digital fandom into longer, more memorable experiences.

- Creator & influencer partnerships: Brands hire streamers and personalities to host events, participate in sponsored streams, and endorse products. This is often the most effective short-term ROI channel for awareness and trial.

- Product integrations: For endemic brands, it’s literal — co-branded peripherals, limited edition hardware, or in-game skins. Non-endemic brands often integrate via apparel drops, co-branded NFTs, or fintech incentives.

- Infrastructure & grassroots investments: Some sponsors invest in facilities, bootcamps, or community programs (scholarships, amateur leagues). These are longer-term brand bets that build goodwill and pipeline.

- League & rights deals: Sponsoring a league or a franchised slot offers consistent, global brand exposure. Rights holders and publishers often sell tiered packages that include broadcast integration, team partnerships, and hospitality.

The modern sponsor must juggle all these levers, and the best activations are multi-channel — a blend of content, events, product, and creator-led moments that feed each other.

Case studies: real deals and what they reveal

To make this concrete, here are a few representative examples that show how different sponsors approach esports differently.

Red Bull — deep cultural integration and athlete storytelling

Red Bull is an archetypal sponsor that treats esports like any other extreme sport they back. The brand doesn’t only buy logo space; it invests in content, athletes, event programming, and grassroots development. Red Bull renewals and partnerships with teams and game publishers show an approach that combines lifestyle positioning with high-engagement content and event activations. Red Bull’s model is instructive for beverage brands and shows how endemic consumer categories can scale across teams and publishers.

Nike — fashion meets competition (and influence)

Nike’s partnerships — particularly in Asia and with major organizations — demonstrate how a legacy apparel brand turns teams into cultural touchpoints. Nike often goes beyond supplying kits; it creates co-branded experiences, training programs, and content that frames pro players as athletes. For Nike and similar brands, esports is an opportunity to translate their sporting heritage into the digital-first world.

Esports World Cup & Club Partner Programs — institutional investment in infrastructure

The Esports World Cup’s Club Partner Program (and other similar initiatives) represents a different sponsor archetype: organisations that allocate capital to grow the ecosystem. These programs often provide funding directly to teams and clubs to professionalize operations, expand international reach, or build competitive infrastructures. This kind of investment is less about immediate product placement and more about long-term market development.

Sentinels x Red Bull — hybrid endemic/non-endemic collaboration

Sentinels’ partnership with Red Bull is an example of a team pairing with a global beverage brand to power activations, fan events, and content. What’s interesting here is that the partnership emphasizes both community-facing experiences and multi-year activations — a sign that brand-team relationships are becoming deeper and more strategic.

What sponsors are buying (and why it matters)

When you buy an esports sponsorship, you’re not just buying a logo. Modern sponsorships are packaged as combinations of:

- Broadcast integrations: in-stream graphics, ad slots, and vertical content for platforms like Twitch and YouTube.

- Owned content ecosystems: series, short-form clips, and social-first videos.

- Talent deals: streamer endorsements and creator collaborations.

- Event branding and hospitality: physical presence at live events.

- Community programs: amateur leagues, scholarships, or bootcamps.

Brands pick bundles based on what they want: awareness, engagement, product trials, data capture, or cultural relevance. A finance brand might prize hospitality and brand safety, an apparel brand might want product placements and co-branded drops, while a hardware firm wants athlete endorsements and on-stage tech demos.

Measuring ROI: what success looks like

One of the biggest challenges for sponsors is measurement. Esports sponsorships offer a variety of measurable outcomes, but clarity depends on activation design.

Common KPIs:

- Impressions and reach (stream views, social reach).

- Engagement metrics (chat activity, likes, shares, and watch time).

- Brand lift studies (recall, favorability, purchase intent).

- Conversion & trial (promo code redemptions, product pages visited).

- Community metrics (Discord growth, org membership sign-ups).

- Sales attribution (harder for big consumer brands, but possible with limited drops or promo codes).

The best sponsorships tie content and creator activations to measurable business outcomes — e.g., a fintech sponsor offering an exclusive sign-up bonus through a team’s stream. But many brands still value longer-term metrics: cultural cachet and preference among young consumers. That makes a hybrid measurement approach — combining immediate conversions with brand lift and long-term cohort tracking — the most realistic path.

Pitfalls and what sponsors must avoid

Esports presents unique reputational and operational challenges for sponsors. Here are common pitfalls and how brands mitigate them:

- Poor partner fit: Sponsorships fail when a brand and team’s values don’t align. Rule: choose partners whose audiences and cultural tone match your brand voice.

- Short-term thinking: Esports audiences value authenticity. Brands that parachute in for a single campaign risk being called out for opportunism. Long-term commitments — multi-season or multi-event — tend to perform better.

- Inadequate content investment: Slapping a logo on a stream yields poor returns. Brands need to produce tailored content and support creators in a meaningful way.

- Neglecting community: Esports communities value two-way interaction. Brands that engage in passive broadcasting miss the engagement opportunity.

- Regulatory and brand safety risks: Betting sponsors, alcohol, and other regulated categories must navigate platform policies and age-restriction complexities carefully.

The creator economy: where most of today’s ROI lives

If you look behind the scenes of most sponsorship success stories, creators are the multiplier. Streamers and influencers consolidate attention, translate brand messages into native formats, and deliver measurable engagement. Many brands now allocate substantial portions of their esports budgets to creator-led campaigns, leveraging smaller, high-trust personalities as well as headline streamers.

Creator partnerships are flexible: they can be short, content-driven bursts, or long-term ambassadorships. Either way, the authentic voice of creators often beats banner ads for conversion.

Regional differences matter

Esports is global but regionalized. A sponsorship that works in South Korea or China often needs to be repackaged for North America or Europe.

- Asia: Massive audience hubs, strong league structures, and high commercial interest from apparel and telco brands.

- North America: Creator-driven, franchise leagues, and growing interest from traditional sports and finance sponsors.

- Europe: Tournament-centric, publisher-driven ecosystems with strong local activations and festival-style events.

- Latin America & MENA: Rapid growth markets where telcos, beverage brands, and local conglomerates are starting to invest heavily.

Brands must adapt activation and measurement strategies to local platform preferences (e.g., which streaming platforms dominate in each market) and cultural expectations.

Emerging trends sponsors are watching

Here are a few trends shaping who invests and how:

- Non-endemic mainstreaming

Non-endemic brands are not experimenting as one-offs anymore; they’re building sustained programs. Apparel, finance, and automotive are particularly active. This trend shifts sponsorships from novelty to strategic channels for long-term brand building. - Rights & event consolidation

As major publishers build franchised leagues and global events consolidate viewership, sponsorship rights become premium inventory — attractive to big global brands willing to pay for consistent exposure - Creator-first investments

More brands put creators at the center of sponsorship activation. Creators craft native, high-trust content that often outperforms traditional ads. - Product and commerce integration

Co-branded drops, limited-edition hardware, and integrated commerce experiences turn sponsorships into direct revenue channels. - Community funding & infrastructure

Some sponsors shift from sponsorship to ecosystem-building investments — funding grassroots, teams, and facilities that grow the sport and create long-term partners. - Data-driven targeting and measurement

Sponsors increasingly demand clearer attribution. This pushes activations toward promo-linked campaigns, special offers, and richer data pipelines.

Predictions: who will invest next?

If you’re looking for sectors likely to expand their esports footprint in the next 2–5 years, watch:

- Luxury & lifestyle brands testing creator collaborations and limited drops to reach affluent young consumers.

- Private equity & institutional investors funding org consolidation and franchising deals as esports matures.

- Telecommunications and cloud providers increasing investments tied to infrastructure & performance guarantees for streaming.

- Finance & fintech scaling up due to the lifetime value of digitally native customers (and through activations that integrate payments and digital goods).

- Traditional sports leagues and brands that bridge their audience with esports through hybrid events and athlete crossover.

These investors will continue to diversify the sponsorship base, making esports less dependent on endemic players and more of a mainstream marketing channel

Tactical checklist for brands considering esports sponsorship

If you’re a marketer evaluating your first (or next) esports deal, use this checklist:

- Define your objective: Awareness, conversion, brand relevance, or community building? Each objective needs a different activation mix.

- Choose your entry point: League rights, team partnership, event sponsorship, creator partnerships, or grassroots investment.

- Match brand voice and audience: Ensure the partner’s culture and audience align with your brand values.

- Design measurable activations: Incorporate promo codes, sign-up incentives, or product drops to capture direct response.

- Invest in content: Allocate budget for production and creator support — not just logo placement.

- Plan for long-term: Commit for multiple seasons if you want authentic engagement and better returns.

- Localize activations: Tailor the campaign for regional platform preferences and cultural nuances.

- Prioritize brand safety: Have protocols for moderation, content approvals, and contractual clauses for reputational risk.

Closing: sponsorships are maturing — and so should brands

Esports sponsorships have matured from opportunistic logo placements into nuanced investments that require strategy, cultural sensitivity, and measurement. Who’s investing? Everyone from endemic hardware makers to global apparel giants, finance firms, automotive companies, and event rights holders. The most successful sponsors are those who treat esports not as an advertising channel but as a culture to partner with: they fund content, support creators, and build experiences that feel native to fans.

If you represent a brand and are considering esports, think beyond impressions. Invest in creators, activate locally and globally, measure thoughtfully, and — crucially — commit for the long run. Treat the relationship with the community like a two-way conversation, and you’ll stand a much better chance of turning sponsorship dollars into lasting brand value.